Uncovering the growth of Swiss start-ups

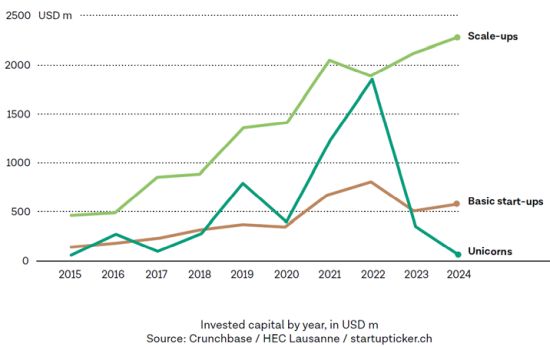

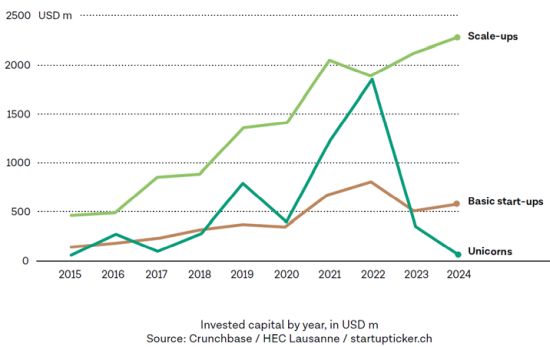

The new Swiss Startup Radar identifies almost 350 scale-ups and 18 unicorns in Switzerland which is a high proportion compared to other countries. The good performance is a result of the steady increase in investments in scale-ups over the last ten years, which slowed down only briefly after the coronavirus hype. In 2024, the amount invested in Swiss scale-ups reached a record high putting the local ecosystem in a good position in international comparison. Per capita, the amount invested in Switzerland in 2024 was as high as in the USA and Israel and higher than in the UK, Sweden or the Netherlands, for example. In addition to the relatively high number of scale-ups in Switzerland, these companies are particularly attractive to investors. The Swiss start-up ecosystem is therefore more advanced in terms of growth than is often claimed.

Scale-ups are defined as start-ups that have raised a total of USD 20 million or more. Our data analyses show that this simple criterion is sufficient to distinguish faster-growing companies from the multitude of start-ups.

Nevertheless, there are challenges, but these are also more advanced. An international comparison shows that the financing difficulties of Swiss scale-ups only begin seven or eight years after their foundation in Series B rounds.

Although a high proportion of scale-ups complete Series B rounds in international comparison, these are smaller than in countries such as Germany, the USA or the UK. Another challenge is apparently recruitment. Swiss scale-ups clearly create fewer jobs than companies from comparable countries.

It is often assumed that Swiss scale-ups are sold early due to a lack of growth capital and recruitment problems. However, this assumption cannot be confirmed by the data. The rate of scale-up exits is relatively low compared to other countries. In order to reach the next stage in the development of the ecosystem, not only is more growth capital needed, but also more exits. This would attract more investors and at the same time increase the pool of talent with growth experience who would be available to build further scale-ups.

Different development paths from the beginning

Scale-ups can be identified early in their life-cycle because they quickly attract significantly larger investment sums than basic start-ups, and it is usually clear as early as the seed round whether a start-up will become a scale-up. A new company that takes more than two years to close a seed round and attracts less than USD 1 million is highly unlikely to develop into a scale-up. Scale-up teams have high ambitions from the outset and are capable of realising them. And in addition investors are able to identify these particularly promising companies.

In terms of unicorns, Startup Radar shows that Switzerland has some ground to make up. Swiss unicorns are developing more slowly, generating significantly less venture capital than unicorns from comparable countries and also creating fewer jobs.

To determine Switzerland’s growth potential, we refer to a regression analysis that examined the prerequisites for particularly high investments. The most important prerequisites identified were the participation of a unicorn investor, deep tech products or services, and the earliest possible completion of the first financing round. Swiss scale-ups are well positioned in terms of attracting unicorn investors and the time to first investment, and even excel in terms of deep tech. This is a strong indication that the potential has not yet been fully exploited.

The most important figures: